-

How to open an FBS account?

Click the ‘Open account’ button on our website and proceed to the Personal Area. Before you can start trading, pass a profile verification. Confirm your email and phone number, get your ID verified. This procedure guarantees the safety of your funds and identity. Once you are done with all the checks, go to the preferred trading platform, and start trading.

-

How to start trading?

If you are 18+ years old, you can join FBS and begin your FX journey. To trade, you need a brokerage account and sufficient knowledge on how assets behave in the financial markets. Start with studying the basics with our free educational materials and creating an FBS account. You may want to test the environment with virtual money with a Demo account. Once you are ready, enter the real market and trade to succeed.

-

How to withdraw the money you earned with FBS?

The procedure is very straightforward. Go to the Withdrawal page on the website or the Finances section of the FBS Personal Area and access Withdrawal. You can get the earned money via the same payment system that you used for depositing. In case you funded the account via various methods, withdraw your profit via the same methods in the ratio according to the deposited sums.

Fibonacci fan

Fibonacci fans is a tool that will help you to analyze trends.

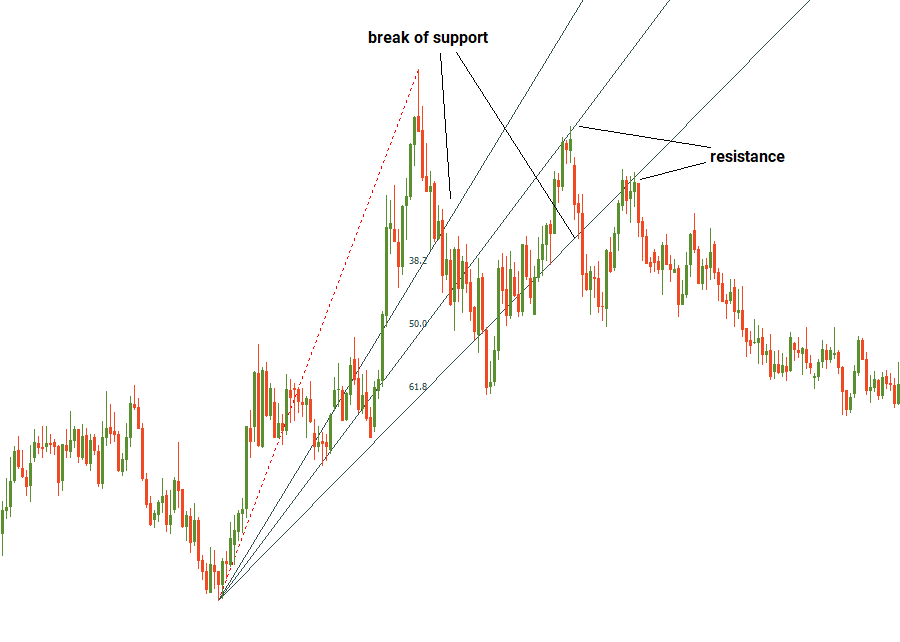

Fibonacci fans are sets of trendlines drawn from a high or a low of the price chart through a set of points dictated by Fibonacci retracements. Just like with Fibonacci retracement, you need to choose the tool and connect a swing high and a swing low with a base line.

Then an “invisible” vertical line, equal to the vertical distance between the high and the low, is drawn from the second extreme point to the level of the first extreme point. Three trend lines are then drawn from the first extreme point so they pass through the invisible vertical line at the Fibonacci levels of 38.2%, 50.0%, and 61.8%.

Fibonacci fans lines can act as support or resistance pinpointing areas at which the price may reverse. As soon as a correction starts, Fibonacci fan will allow you to see the areas to which you should pay special attention.

- Corrections (pullbacks) to 38.2% Fibonacci are considered shallow and point at the continuation of the main trend.

- A pullback to 50% is moderate and can be observed quite often.

- A correction to the so-called “golden ratio” of 61.8% is more rare, but this level of support/resistance will be the strongest of the three.

Notice that because of the properties of the fan, the further out the lines extend (in time), the more sensitive they are to exact placement of the two marker points. This means a small change in placement of either of the marker points can result in large movements further out in the extension lines. The fan usually becomes less accurate the further out it extends. When the price is no longer responding to the support or resistance areas of the fan, it is disregarded (this can happen when it extends outside of the active chart area).

Sometimes technical analysts plot several Fibonacci fans using different waves of the prices. This allows to place potential reversal areas of the price with greater precision.

2023-11-21 • Updated

Other articles in this section

- Fibonacci expansion

- How to Use Fibonacci Retracements

- Reversal candlestick patterns

- Continuation candlestick patterns

- How to deal with market noise?

- How to backtest a trading strategy

- Gator Oscillator

- Market Facilitation Index

- Accelerator Oscillator

- Awesome Oscillator

- Ranges

- Alligator indicator

- Bill Williams theory

- Fractals

- Chart patterns

- Uncovering Gann indicators

- How to create your own trading strategy?

- Candlestick patterns

- Trend trading

- Carry trade

- Swing trading

- Position trading

- Day trading

- Scalping

- Fibonacci tools

- Trader's psychology

- How to identify market reversal

- Japanese Candlesticks

- Trends